flow through entity private equity

When a PE firm structures an LBO transaction some PE investors generally tax-exempt and foreign investors will invest directly or indirectly in portfolio company equity through one or more newly-formed Delaware C corporations the blocker corporation. Fund A and Audax Private Equity Fund V-B LP.

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Blocker corporation to hold an investment in a US.

. It is typical in private equity funds for certain tax-sensitive investors including us. 11 See Cordero 2018. A better way to measure the companys performance by Investment banks Investment Banks Investment banking is a specialized banking stream that facilitates the business entities government and other organizations in generating capital through debts and equity reorganization mergers and acquisition etc.

Most governmental plans take the position that as governmental entities. Do Private Equity Investments Issue A K-1. Federal income tax purposes while allowing United States taxable investors to avoid corporate level tax on such investments Audax Private Equity Fund V-A LP.

Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

Gretchen Whitmer signed legislation on Dec. Ultimately in determining whether to structure an investment for QSBS or via a flow-through structure a private equity buyer will need to analyze based on projections the IRR generated by each alternative structure. A flow-through entity is also called a pass-through entity.

One reason for such restrictions is a funds need to avoid. Tax exempts and non-us. Typical features of the general partner in a basic private equity structure Usually a US or flow through entity in which the participants include - Principals - Can be an investment bank or other financial institution provide services as employees Features of the management company a US or flow through entity Participants.

Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has. 150 which contains the small business relief act creating an elective pass-through entity pte level tax available to certain qualified entities and a pte tax credit available to certain qualified taxpayers.

The pass-through entity can be defined as a process by which any organization will be relieved from double taxation burden. Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities. JPE-Spiroindd 12 051119 148 pm RSULJKW 3DJHDQW0HGLD WG.

Generally determined at the level of the taxable equity holder of the flow-through entity. 20 2021 to provide an elective flow-through entity FTE tax. Structuring Newco as Flow-Through Entity 301 NEWCO AS S CORP 34 3011 Limited Liability and General Characteristics 34 30111 General 34.

The income of the owners of flow-through entities are taxed using the ordinary. Typical features of the general partner in a basic private equity structure answer Usually a US or flow through entity in which the participants include - Principals - Can be an investment bank or other financial institution provide services as employees question Features of the management company answer. The Schedule K-1 package for PE or VC funds organized as flow-through entities for tax purposes must be provided to investors which may include both federal and state K-1s as well as possible withholding tax reports.

1 As a result Michigan is the latest state to enact an entity-level tax regime as a workaround to the federal 10000 state and local tax SALT deduction limitation adopted under the Tax Cuts and Jobs Act TCJA of 2017. Troy Helping business owners for over 15 years. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

The income of the business entity is the same as the income of the owners or investors. The reason for passing through income structure is that the owners otherwise get double taxed Double Taxed. 2 On the same day.

States investors the opportunity to invest through a structure designed to block certain taxable income from investments in flow through entities for US. Governor Whitmer signed HB. Gavin newsom signed assembly bill 150 ab.

Gretchen Whitmer signed HB 5376 allowing eligible owners of pass-through entities to have the pass-through entity pay Michigan taxes at the entity level and then receive a refundable credit on their own tax return for their share of the entity level Michigan tax paid. It is typical in private equity funds for certain tax-sensitive investors including US. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below.

November 19 2021 BY. These rules can be a trap for the unwary for example in the case of PE -backed portfolio companies operating in flow-through form which can result in CODI dry income to the private equity PE sponsor and its limited partners LPs. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US.

The entity passes its total income to the entitys owners and therefore taxes are calculated on the individual basis on each and every owner. Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap February 03 2022 by Bryan Bays. 1057 Formation of Private Equity Venture Capital or Buyout Fund 113 106 HISTORY OF PRIVATE EQUITYVENTURE CAPITAL INVESTING 113.

Planning devices can include the following. On july 16 2021 california gov. 150 makes california the latest in a wave of.

A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below. Blocker corporation rather than a US. Venture capital funds and private equity funds typically contain significant limitations on the ability of investors to transfer their partnership interests.

Of a flow-through entity. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Blocker to exit its investment in the US.

For individual owners the new provisions provide relief from the federal income tax. Flow-through portfolio company as the court decision may permit the non-US. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels.

Tax exempts and non-US. Or other flow-through entity is attributable to the flow-through entitys interest direct or indirect in the. Investors such as sovereign wealth funds to.

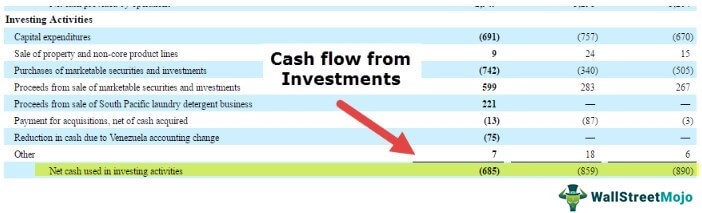

Cash Flow From Investing Activities Formula Calculations

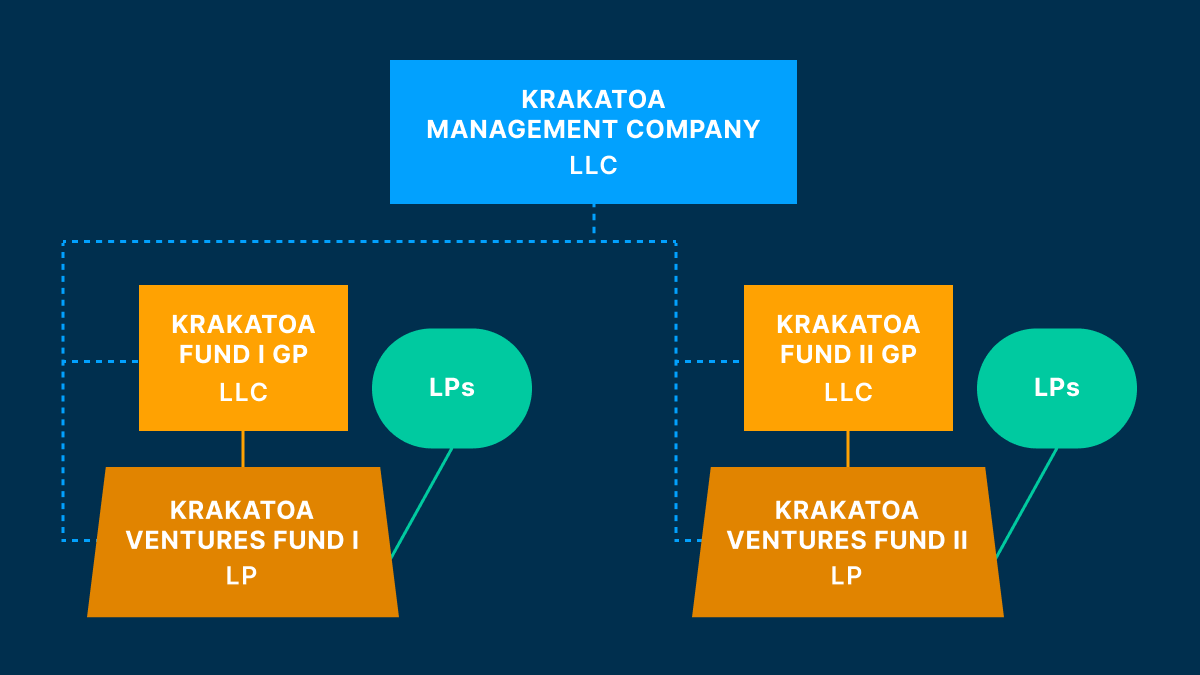

Private Equity Fund Structure A Simple Model

Aifs Indian Experiments Way Forward With Tax Efficiency

The Legal Structures Of Venture Capital Funds Carta

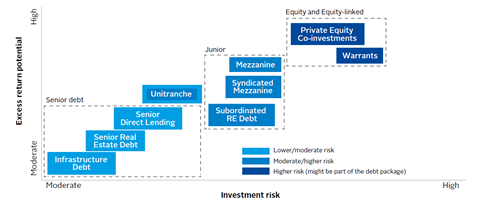

An Overview Of Private Debt Technical Guide Pri

Private Equity Internship The Track For Early Rising Stars Bankingprep

Carried Interest Guide For Private Equity Professionals

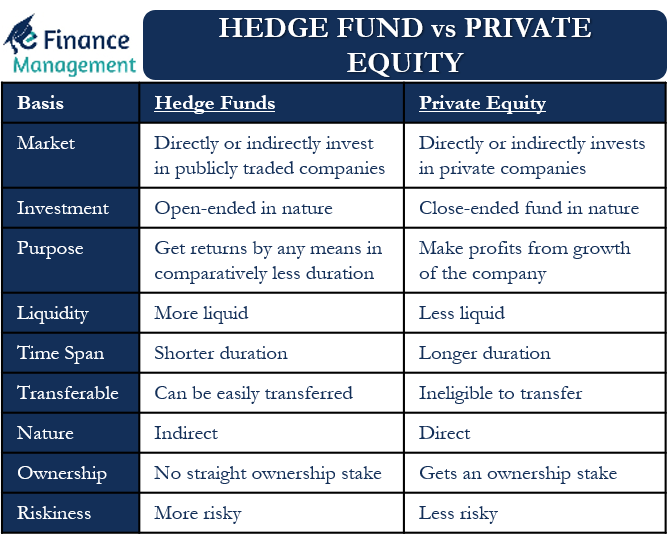

Hedge Fund Vs Private Equity Meaning Differences And More Efm

Reserve Bank Of India Database

Private Equity Meaning Investments Structure Explanation

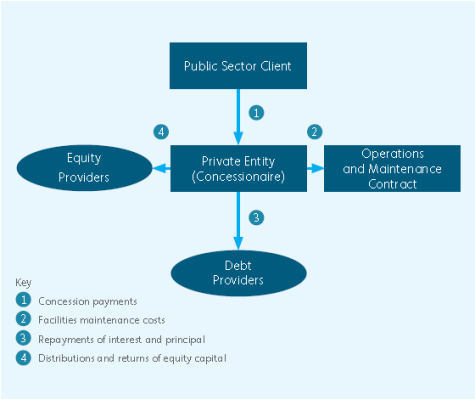

What Are Public Private Partnerships

Reserve Bank Of India Database

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Pass Through Entity Definition Examples Advantages Disadvantages

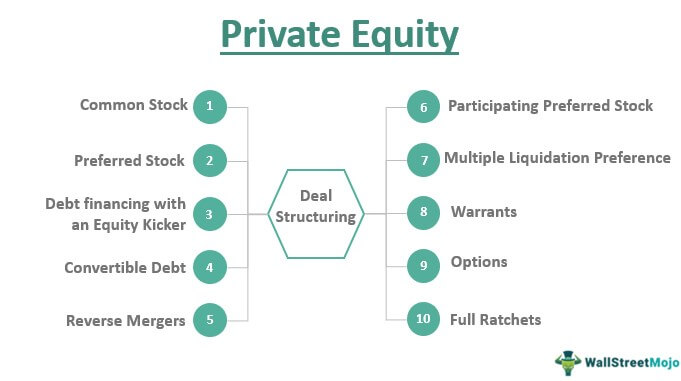

What Is Private Equity Deal Structure Flow Process Guide

Private Equity Internship The Track For Early Rising Stars Bankingprep

What Is Private Equity Deal Structure Flow Process Guide

Pass Through Entity Definition Examples Advantages Disadvantages